How to calculate the monthly payment on the mortgage formula. Calculation of mortgage with annuity payments.

- How to calculate the annuity mortgage with early repayment?

- Interest formulas

- Early repayment to reduce the loan amount

In regular relations with credit organizations, their clients late or early think about how the bank calculates loans and deposits. The annuity mortgage borrower is particularly interested to know how a financial institution builds a payment schedule, according to early repayment mortgage loan. In this article we will shed light on all these questions.

How to calculate mortgage with annuity payments?

In fact, anyone can independently calculate mortgage payments using the same simple formulas as a bank. We will give these formulas and show by example how to calculate the annuity loan and the early repayment of a loan with this type of payment. But first let us see what this concept means, and what other schemes are used when paying a mortgage loan.

In the case of mortgage payments can be calculated on a differentiated or annuity basis. Differential (changeable) payments suggest a monthly decrease in the amount that is given to repay a mortgage loan. An annuity (permanent) payment involves equal monthly payments on loan obligations by the borrower, and is calculated using the annuity formula.

The entire period of the mortgage agreement, the borrower periodically transfers to the bank the same amount, part of which applies to the repayment of the loan, and part - to pay interest. At the beginning of the loan period, interest payments prevail in this amount, and at the end, on the contrary, payments for debt repayment. Such a mortgage repayment, although more in the total differential payment amount, but gives stability to the borrower in the amount of his monthly loan costs.

In Russia, they like stability and consistency, which is why we have exactly the annuity payments received the most widespread. This method of loan repayment is convenient for planning the budget of the borrower, since the entire term is the same amount. Moreover, at the first stage of mortgage repayment, the size of annuity payments is lower than the size of differentiated payments.

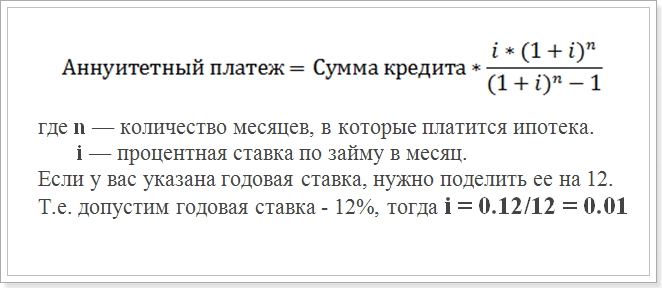

So, let's say you are trying to carry out the calculation of the annuity payment, according to the schedule. Usually in banks use the following formula:

Annuity Payment Formula

This value (i) and should be used in the calculations.

This formula is the most common, and is used in large banks such as Sberbank, VTB 24 and DeltaCredit Bank. However, there are other formulas by which you can calculate the constant payments on a mortgage loan, so if you meet somewhere another way to calculate the annuity payment, it does not mean that it is not correct.

How to calculate the annuity mortgage with early repayment?

Of particular interest is the payment schedule when the early repayment of the loan is carried out. The credit institution itself, before the official application of the borrower, does not consider it, and to know how much the amount of payments will be after the early repayment is made necessary. Perhaps 2 types of early repayments - with a decrease in the loan term and with a decrease in the amount of payment. However, in any case, the same formula will be used.

An example of calculating the annuity mortgage schedule after early repayment. For the sample, we take a loan with the following parameters:

- Amount: 1 000 000 rubles

- Duration: 60 months (5 years)

- Interest rate: 12%

- Date of first payment: September 1, 2015.

Using the above formula, we get the following payment schedule:

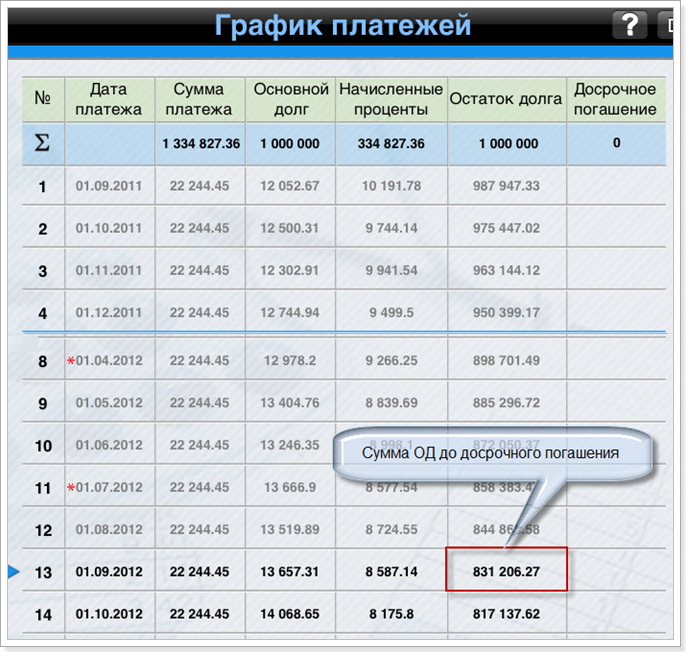

Payment schedule after prepayment

Remember that early repayment without penalty can be carried out only after 1 year of payments. Therefore, we consider the 12th and 13th month.

Interest formulas

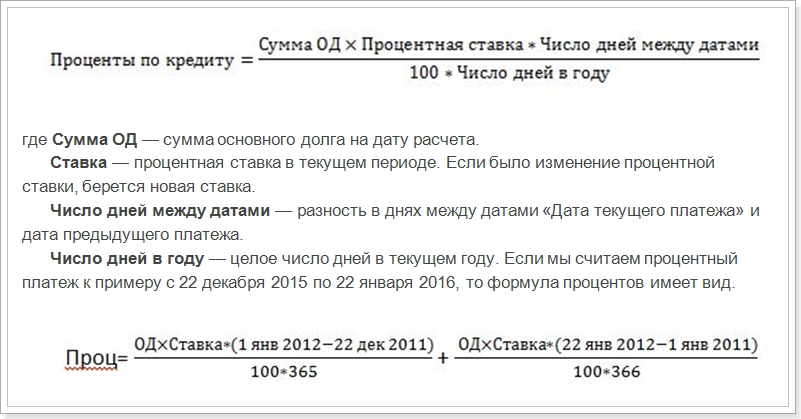

Considering the calculation of the schedule of payments of the annuity loan, it should be noted that in addition to the above formula, there are schemes for calculating the amount of repayment of the principal and interest of the monthly payment. Consider these formulas:

Annuity payment = Redemption of OD + Interest,

where Interest is the amount of interest on the loan for the month,

Repayment of OD - the amount to repay the loan body.

The formula for calculating the percentage of monthly payment

That is, it is necessary to calculate separately for December and January, depending on the number of days in a year. However, in our example, this is not necessary. We need to calculate the first payment in interest payments for September (the difference between the dates of 31 days).

As can be seen from the graph, in the first month the amount of ML is 1,000,000 rubles. Substitute the rates, dates and the number of months in the year and get an indicator equal to 10191, 78 rubles, that is, this is the amount that should go into account for the payment of interest.

And now let's calculate the amount in early repayment of the loan body:

22244.45 - 10191.78 = 12052.67 rubles

Then we calculate the amount of the principal debt after paying the first installment on a mortgage loan:

1 000 000 - 12052.67 = 987947.33 rubles

In the future, interest will be charged on this amount. Then you can calculate the schedule of all payments. From this graph, we see that as of September 1 (the 13th month) the amount of principal debt as of September 1, 2016 will amount to 831,206.27 rubles.

Early repayment to reduce the loan amount

Now let us assume that you repaid 100,000 rubles ahead of schedule in August 2016 to reduce the loan amount, that is, the loan term will remain the same, but monthly payment will decrease. Then we will try to calculate what the payment will be after the early repayment is made. For this we use the formula for calculating annuity. Of all the parameters, only the amount of the principal debt has changed. After early installments in August, it is equal to:

831206.27 - 100000 = 731206.27 rubles

This amount will be the amount of the loan after the implementation of early repayment. And already on the basis of this indicator, a monthly annuity payment after early repayment will be calculated.

However, the loan term will also change:

Loan term = 60 - 13 = 47 months

Substitute the new amount into the annuity payment formula and get a new mortgage payment:

Annuity = 731206.72 * 0.01 * [(1 + 0.01) 47 / (1 + 0.01) 47-1]

Since (1 + 0.01) ^ 47 = 1.596263443 , and 1.596 - 1 = 0.596263443 , the final calculation will look like this:

731209.72 * 0.01 * 1.596263443 / 0.596263443 = 19575,20374 rubles

Schedule and amount monthly payments mortgage can be used for reconciliation with the calculation of the bank. However, sometimes the data may not be the same as the lender may use a different formula that can be found in the mortgage agreement. There are also indicated the parameters that need to be substituted into the formula. Therefore it is better to use online loan calculator on the website of the bank where you plan to take a mortgage.

At the same time, you should understand that from a financial point of view, early repayment is not always profitable. And if you want to quickly discharge your debts, you will have to pay more.

How to calculate the annuity mortgage with early repayment?How to calculate mortgage with annuity payments?

How to calculate the annuity mortgage with early repayment?